Tally all cash inflows and outflows from fundraising and repaying debts that allow the company to operate or grow. Tally all cash inflows and outflows related to buying and selling property and assets that increase the value of the business. Along with the balance sheet and income statement, this set of financial documents are required for both private and public companies. Having cash and cash equivalents on your balance sheet shows investors or lenders that your business is financially healthy. If your revenues take a dive, you can still stay on top of your bills and other short-term liabilities.

The difference between direct and indirect cash flow statements

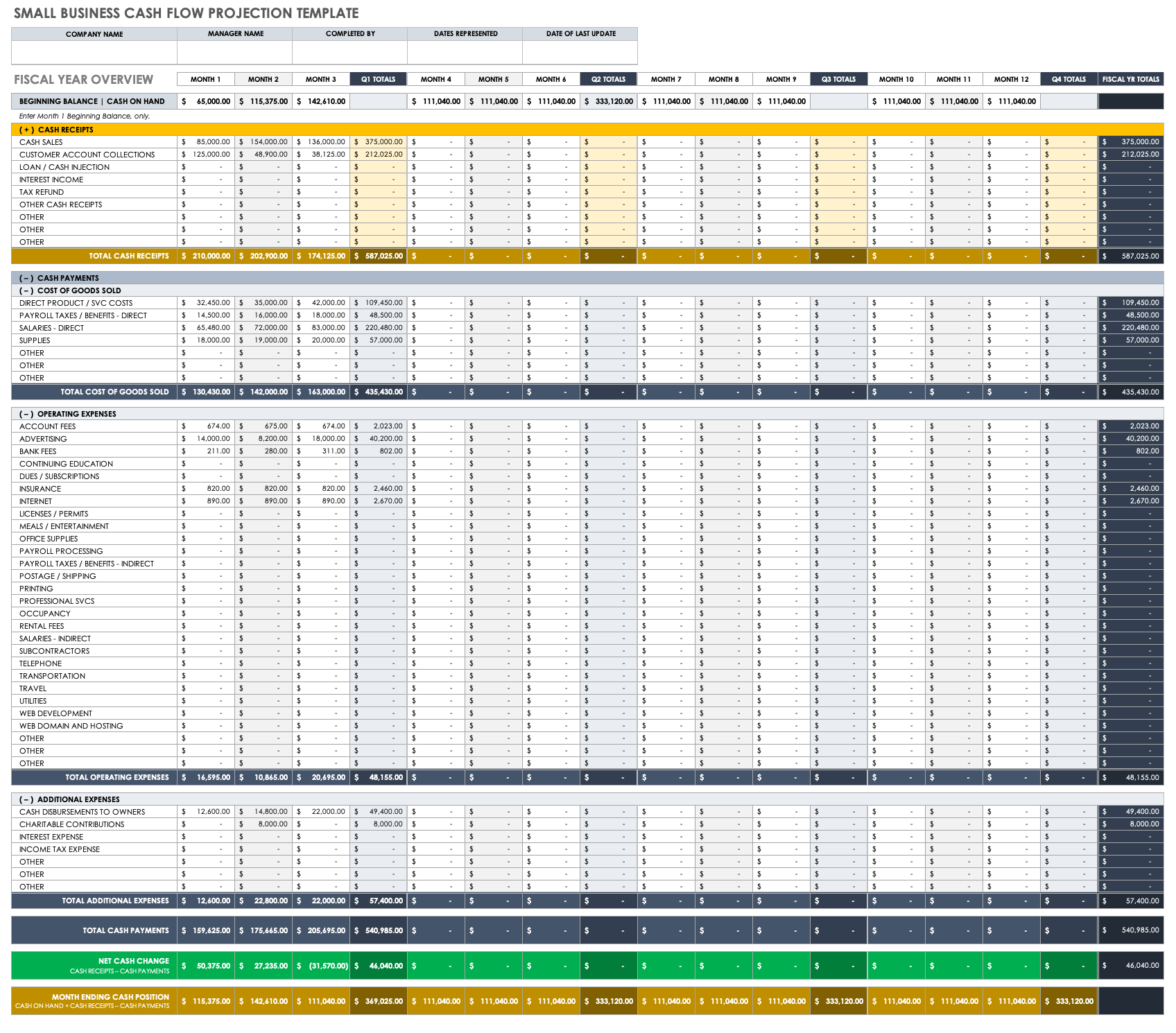

Keep track of how you are spending money to gain more control over your financial habits and outlook. Below you’ll find a collection of easy-to-use Excel templates for accounting and cash flow management, all of which are fully customizable accounting for loans receivable and can be downloaded for free. The fields in the tan colored cells of the spreadsheet are left blank for you to enter your own figures, and you can also change labels for these rows to reflect your own categories of cash flows.

Accounts Receivable Template

Liquidity refers to your business’s ability to generate enough current assets to pay current liabilities. If your company can produce cash inflows over the long-term, you can pay for capital expenditures in the future and repay loan balances. In this example, the cash flow statement is prepared using the direct method, which reports the actual cash inflows and outflows from operating activities. This comprehensive template offers an annual overview as well as monthly worksheets. Create a detailed monthly cash flow report to analyze performance or plan for the future.

Indirect Cash Flow Template

In order to fill out a cash flow statement, you will need your most recent income statement and balance sheet. If using the indirect method, GAAP will use items from the income statement (net income, depreciation expense, etc) to prepare the cash flow statement. Included on this page, you’ll find a simple cash flow forecast template and a small business cash flow projection template, as well as the benefits of cash flow forecasting. Easily create reports to roll up annual, quarterly, or monthly cash flow details so you’ll always have a real-time view of the financial health of your business. In this worksheet, the upper portion is the balance sheet information, and the lower portion is the cash flow statement information. The change in each balance sheet row is evaluated and keyed to a change(s) in the cash flow statement.

A Couple Tips for Entering Amounts

Depending on the size and complexity of your business, you may want to delegate the responsibility of creating a cash flow forecast to an accountant. However, small businesses can save time and money with a simple cash flow projections template. Understanding your company’s cash flow is critical to maintaining a positive cash flow. Additionally, you should plan for seasonal changes that could impact business performance, and upcoming promotional events that may boost sales.

- Once you start using these tools, you need to make changes to improve cash inflows.

- Any articles, templates, or information provided by Smartsheet on the website are for reference only.

- Essentially, your entries show cash in and cash paid out each month for the time period that your cash flow statement covers.

- However, as a general rule, you should have enough cash or cash equivalents to cover three to six months of business expenses.

- This tool can easily be adapted to create a custom cash flow system to suit your business needs.

Use this daily cash flow forecast template to get a pulse on your business’ short-term liquidity. Daily cash flow forecasts are particularly helpful in determining that everything is accounted for and for avoiding any shortfalls. The template calculates cash payments against operating expenses to provide a daily net cash change and month-ending cash positions. This template has everything you need to get a day-by-day perspective of your business’s financial performance and outlook.

Cash equivalents appear as assets on a balance sheet, and include cash along with any liquid investments you can quickly convert into cash. They provide a structured and organized approach to monitoring your cash flow, identifying trends, and making informed financial decisions. You can use this template to perform a cash flow sensitivity analysis in order to anticipate shortfalls and help your business maintain a positive cash position.

The cost of replacement should be included in the restaurant chain’s annual budget. Start by determining your operation’s net income and then converting the accrual net income into operating activity cash flows. Here’s an example of the direct cash flow statement for the sample company ABC Corporation. Make sure to include line items for cash paid to employees, suppliers, and interest.

A negative balance confirms that the company has more cash flowing out than in. Add the value of any increases in operating liabilities such as accounts payable or subtract the value if operating liabilities have decreased. Subtract any cash used to pay the company’s employees, executives and directors. Add any cash receipts from goods (for a product-based company) or services (for a service-based company). If you’re an entrepreneur looking for ways to save costs on business operations, while extending your company’s reach, check out the Wise business account. Cash flow statements are also used when a business is looking for investment or a loan, to demonstrate the company is delivering a profit and using income wisely.

QuickBooks’ free cash flow statement template with built in calculations is a great tool to help your business manage its cash flow. Once you start using our cash flow statement template you will be able to identify changes needed to improve cash inflows. Use this template to create a cash flow forecast that allows you to compare projections with actual outcomes. This template is designed for easy planning, with a simple spreadsheet layout and alternating colors to highlight rows. You get a snapshot of cash flows over a 12-month period in a basic Excel template.