The Trustees are permitted to reimburselaw clients when a lawyer in New York State misuses or steals client moneyand property in the practice of law. Unless an escrow agreement provides otherwise, the loss generally falls onthe party who owned the escrow property at the time of its theft. In thecase of a stolen down payment, that’s usually the buyer, who may be asked bythe seller to replace the down payment before title closes. Of course, aninjured party will have the right to seek money damages from the dishonestescrow agent.

Do you already work with a financial advisor?

Thelawyer must safeguard and segregate those assets from the lawyer’s personal,business or other assets. Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

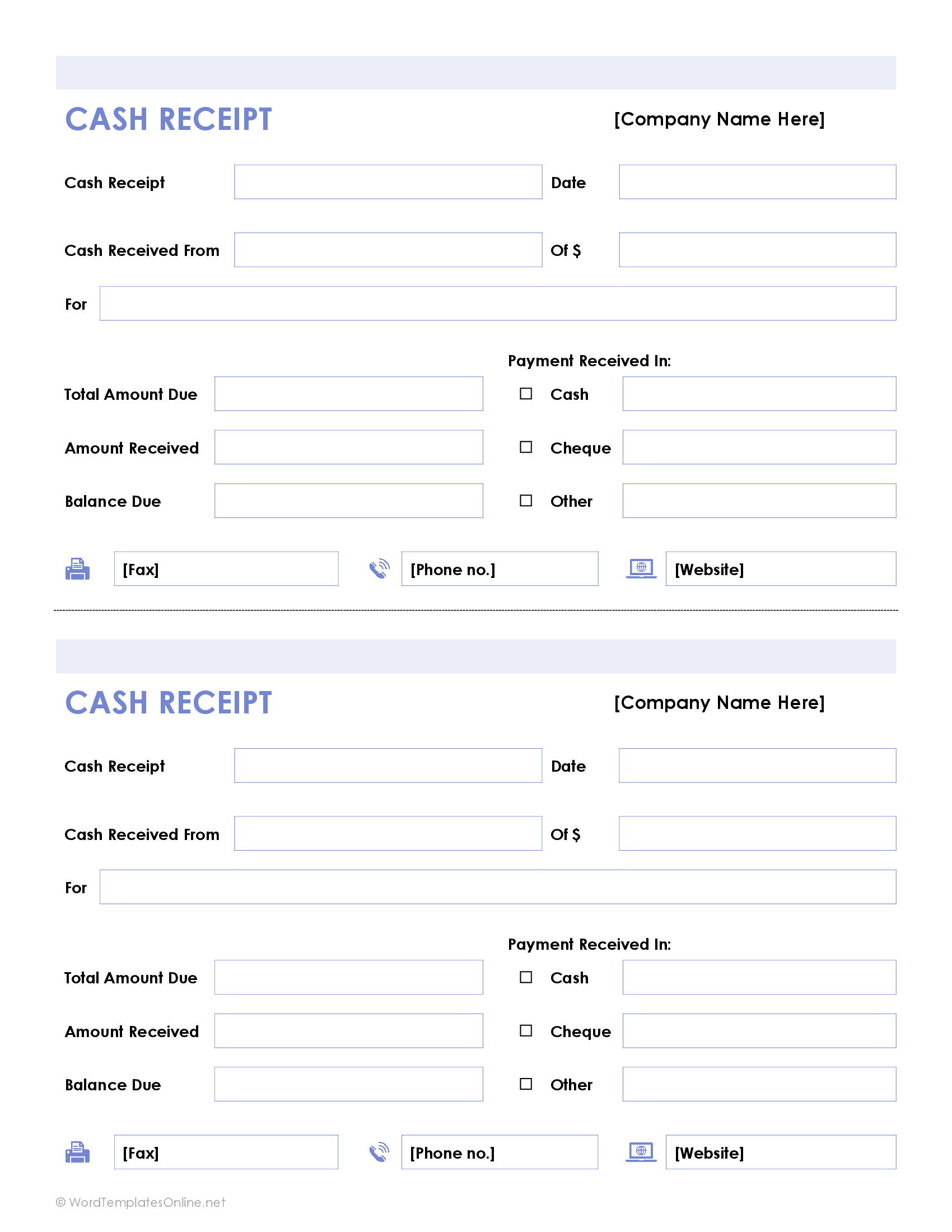

What Information is Included in a Cash Receipts Journal?

The cash disbursements journal itemizes all business expenses made with cash. Typical information included in the disbursement journal is the check number, the payee, disbursement amount, and the transaction type. GAAP attempts to standardize and regulate the definitions, assumptions, and methods used in accounting. There are a number of principles, but some of the most notable include the revenue recognitionprinciple, matching principle, materiality principle, and consistency principle.

Cash Receipt Journal – Definition, Explanation, Format, and More

The credit columns in a cash receipts journal will most often include both accounts receivable and sales. Again, other columns can be used depending on the type of routine transactions that the firm engages in. A cash receipts journal is a very important tool used in the accounting cycle process. They are sources that contain the data that is used to gain valuable insight on the financial aspect of a business.

Combination of cash and credit

Shoeboxed is an expense & receipt tracking app that helps you get reimbursed quickly, maximize tax deductions, and reduce the hassle of doing accounting. Depending on how frequently you get cash from customers, there can be a lot of entries in this journal. My Accounting Course is a world-class educational what is a pay raise at work resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- For example, the cash sale on June 1 is recorded in the cash receipts journal by first entering June 1 in the date column.

- This can cause the customer’s account to be inaccurate and may result in the customer being overcharged or undercharged.

- At the close of business today, you are ready to review your day’s business and make the appropriate entries in your accounting records.

Recording cash receipts offsets the accounts receivable balance from the sale. Other sources of cash often include banks, interest received from investments, and sales of non-inventory assets. When a business gets a loan from a bank, the transaction to record the loan is made in the cash collections journal. When a retailer sells merchandise to a customer and it collects cash, this transaction is recorded in the cash receipts journal.

Making entries in a cash receipts journal is a pretty simple and straightforward process. Manual accounting systems will likely use special journals for recording routine transactions. Accounting principles help govern the world of accounting according to general rules and guidelines. There may be a large number of entries into this journal, depending on the frequency of cash receipts from customers. Cash Basis Accounting is a type of accounting whereby all of the company’s revenues are recognised upon actual cash receipt and all of the expenses are recognised upon payment. It also ensures that the business can keep track of all the account receivables and aged receivables.

Thegeneral journalis the all-purpose journal that all transactions are recorded in. Since all transactions are recorded in the general journal, it can be extremely large and make finding information about specific transactions difficult. That is why the general journal is divided up into smaller journals like the sales journal, cash receipts journal, and purchases journal. A sales journal entry is a journal entry in thesales journalto record a credit sale of inventory.

You typically have many cash receipts during the day for toy, books and candy. You keep track of your sales in your cash register every day and then manually post the day’s transactions at the end of the day. At the close of business today, you are ready to review your day’s business and make the appropriate entries in your accounting records.

This can be beneficial to avoid the headache that can sometimes come with making credit sales. A cash receipts journal is a special journal that records the receipt of cash by a business from any source during an accounting period. It also helps to keep track of the cash sale of items when the cash is received.