If you want to learn more about bookkeeping, then check out our article on what bookkeeping is and what a bookkeeper does. Now that we know the cost of ending inventory, we can use the COGS formula to calculate our COGS. Let’s compute the ending inventory step by step using the sample data taken from the inventory records of a company selling table tennis paddles. Cassie is a former deputy editor who collaborated with teams around the world while living in the beautiful hills of Kentucky.

- When the periodic inventory system is used, the Inventory account is not updated when goods are purchased.

- In the last 10 years, she has worked with clients all over the country and now sees her diagnosis as an opportunity that opened doors to a fulfilling life.

- Companies must track each inventory purchase and sale to ensure accurate application of the method.

- Let us use the same example that we used in FIFO method to illustrate the use of last-in, first-out method.

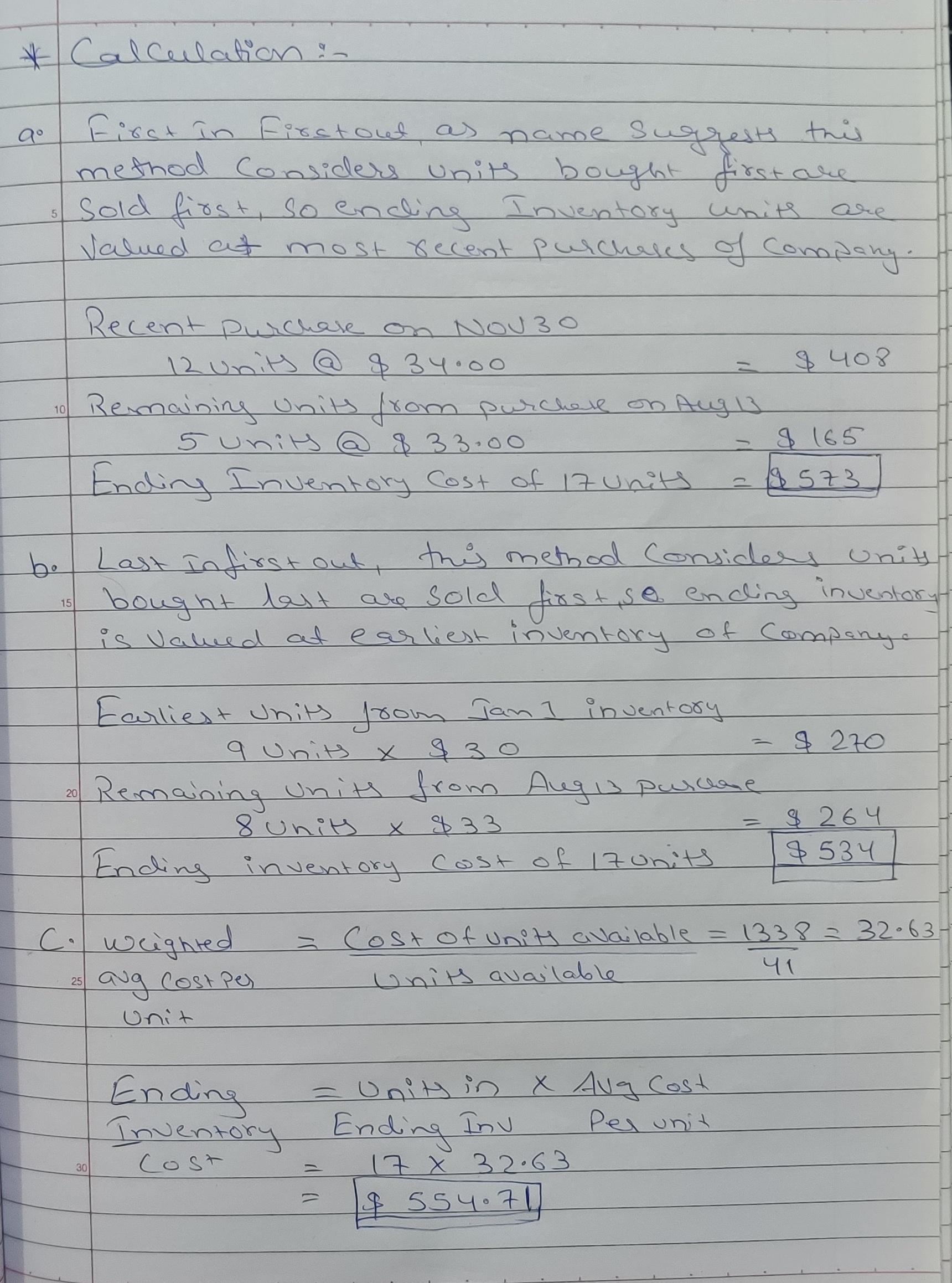

LIFO vs. FIFO

Since we are using LIFO, we must take the last units in, which would be the units from January 12th. Then we would take the remaining 15 units needed from beginning inventory. If you use our LIFO calculator, you will see the result is 144 USD. The company has two groups of inventory – one at $35 per unit and another at $36 per unit.

Comparing Perpetual LIFO and Periodic LIFO

The result of this decline was an increase in earnings and tax payments over what they would have been on a FIFO basis. By switching to LIFO, they reduced their taxable income and their tax payments. This is because the latest and, in this case, the lowest prices are allocated to the cost of goods sold.

What Is LIFO Method? Definition and Example

Inventory turnover can influence the differential between FIFO and LIFO. In any case, by timing purchases at the end of the year, management can determine what costs will be allocated to the cost of goods. In other words, under the LIFO method, the cost of the most recent lot of materials purchased is charged until the lot is exhausted. Kristin is a Certified Public Accountant with 15 years of experience working with small business owners in all aspects of business building. In 2006, she obtained her MS in Accounting and Taxation and was diagnosed with Hodgkin’s Lymphoma two months later. Instead of focusing on the fear and anger, she started her accounting and consulting firm.

This means that the periodic average cost is calculated after the year is over—after all the purchases for the year have occurred. This average cost is then applied to the units sold during the year and to the units in inventory at the end of the year. Most companies use the first in, first out (FIFO) method of accounting to record their sales. The last in, tax deductions and credits first out (LIFO) method is suited to particular businesses in particular times. That is, it is used primarily by businesses that must maintain large and costly inventories, and it is useful only when inflation is rapidly pushing up their costs. It allows them to record lower taxable income at times when higher prices are putting stress on their operations.

How confident are you in your long term financial plan?

Although firms can often plan for LIFO liquidation, events sometimes happen that are beyond the control of management. As noted already, at least a portion of the inventories valued under LIFO is priced at the firm’s early purchase prices; this might go back to the date when LIFO was adopted. In some industries, prices are volatile and thus unpredictable.

Generate spreadsheets, automate calculations, and pay vendors all from one comprehensive system. Try FreshBooks free to start streamlining your LIFO inventory management and grow your small business. The LIFO method assumes that Brad is selling off his most recent inventory first. Since customers expect new novels to be circulated onto Brad’s store shelves regularly, then it is likely that Brad has been doing exactly that.

The weighted average cost of the books is $88 ($440 of cost of goods available ÷ 5 books). The average cost of $88 is used to compute both the cost of goods sold and the cost of the ending inventory. In a periodic inventory system, you only update the inventory account at the end of the period, such as monthly, semiannually, or annually, after a physical inventory count.

This adjustment helps in presenting a more comparable financial picture but requires additional effort and understanding from analysts and investors. The Last In, First Out (LIFO) inventory method operates on the assumption that the most recently acquired items are the first to be sold. This principle contrasts with the First In, First Out (FIFO) method, where the oldest inventory is sold first.